Prevent contact centre fraud, protect customers

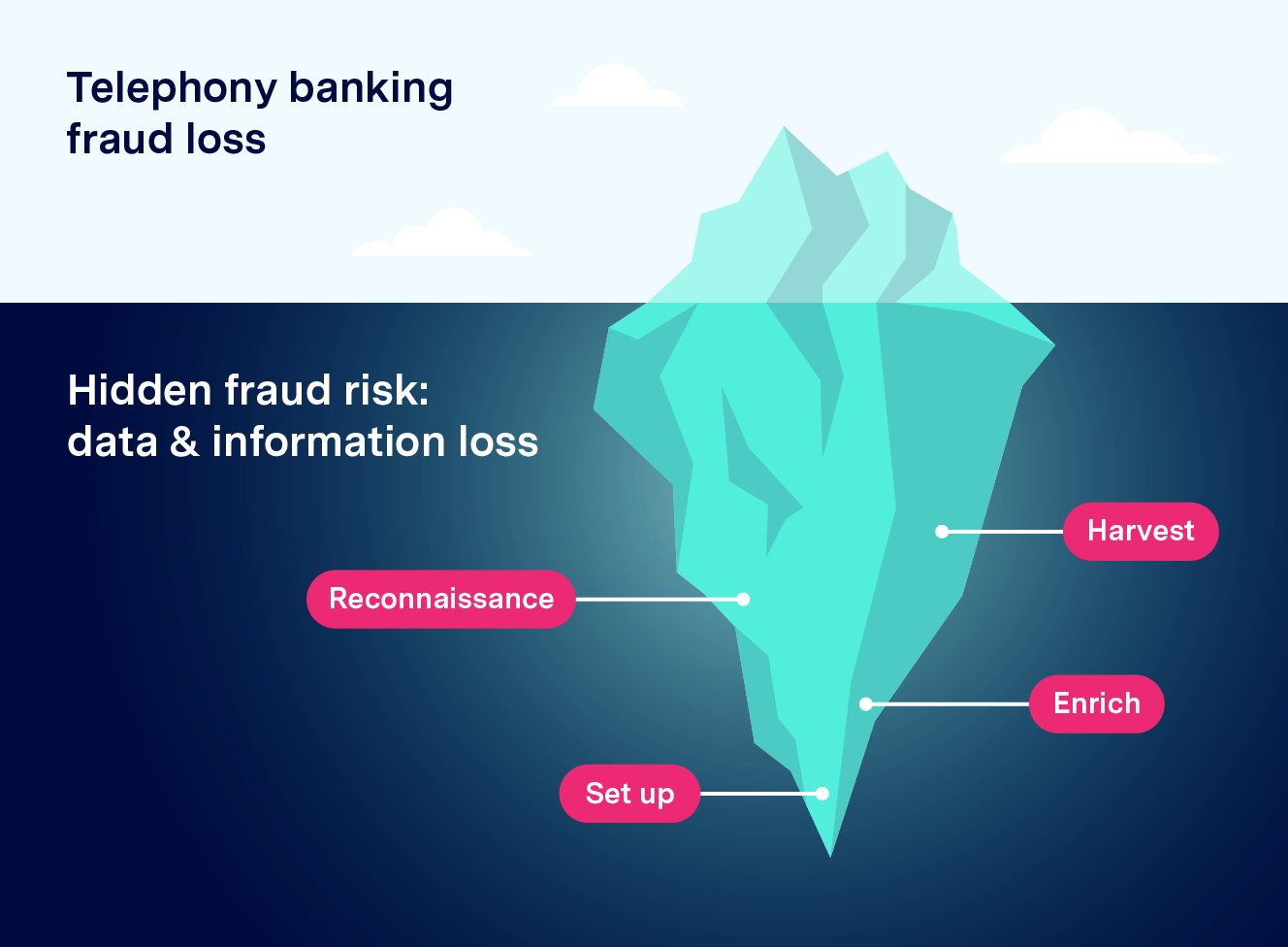

Telephony fraud is only the tip of the iceberg

Contact centres are more vulnerable than you think: 61% of fraud involves the contact centre.

Telephony fraud, where a fraudster takes advantage of stolen personal details to access accounts and steal money by manipulating the IVR or call agent, is just one way contact centres can be hit by fraud.

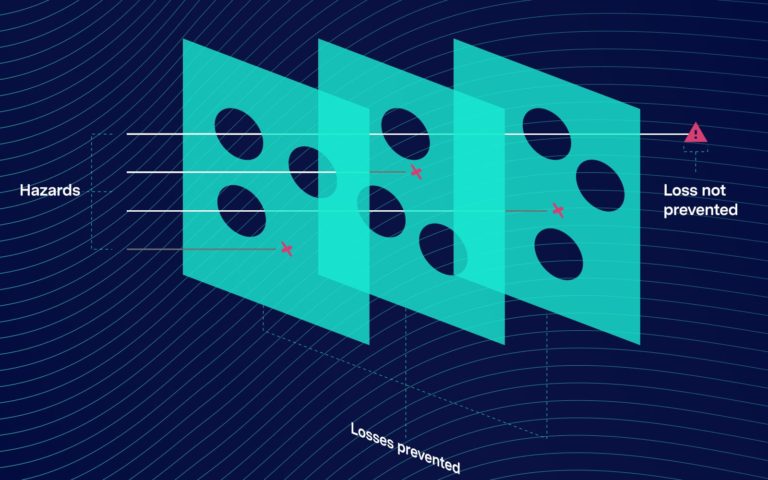

Other more common fraudulent activities involving the contact centre are less obvious and an early sign of further wider fraudulent activity. Fraudsters use the relative vulnerability of contact centres to validate stolen account data, harvest further information, or prepare an account for attack (for example by changing an address) before committing fraud in other channels.

Regardless of how secure your other channels are, telephony is the weak link. This is why it is essential to protect contact centres in the fight against fraud.

We make contact centres more secure and efficient

Smartnumbers’ cloud-hosted platform helps prevent fraudsters from using contact centres to validate stolen information and access customer accounts.

Our technology uses AI to analyse carrier-level signalling data and caller behaviour, and also checks all calls against our consortium database of confirmed fraudsters, to assign an overall risk score for each call.

This will help you:

- Spot signs of fraud and scams which could impact multiple channels (card, online & telephony)

- Reduce Average Handling Time for calls by up to 1 minute and save costs

- Mitigate contact centre fraud losses and ensure fraud savings for up to 8X ROI

- Reduce risks related to privacy and cybersecurity while protecting the end customer

- Protect your brand

Want to find out how Smartnumbers can help you?

Further resources.

Want to find out more?

Book a consultation with a Smartnumbers specialist to learn how Smartnumbers can help you fight contact centre fraud and streamline the customer authentication.