By securing digital channels, PSD2 aims to make payments safer and increase consumer protection.

However, without equivalent security on the telephone channel, contact centres will become more vulnerable and risk frustrating legitimate callers. There is a solution, network-level call firewall using Call DNATM technology.

An overview of PSD2

PSD2 requires that any action through a remote channel, such as a telephone, where there is a risk of payment fraud requires strong customer authentication (SCA). Therefore, the customer’s identity needs to be verified using at least two of the following items before being able to complete the transaction:

– Knowledge: Something the caller knows (PIN or password for example)

– Possession: Something only the genuine customer possesses (such as a card or mobile phone)

– Inherence: Something the user is (such as fingerprint or iris)

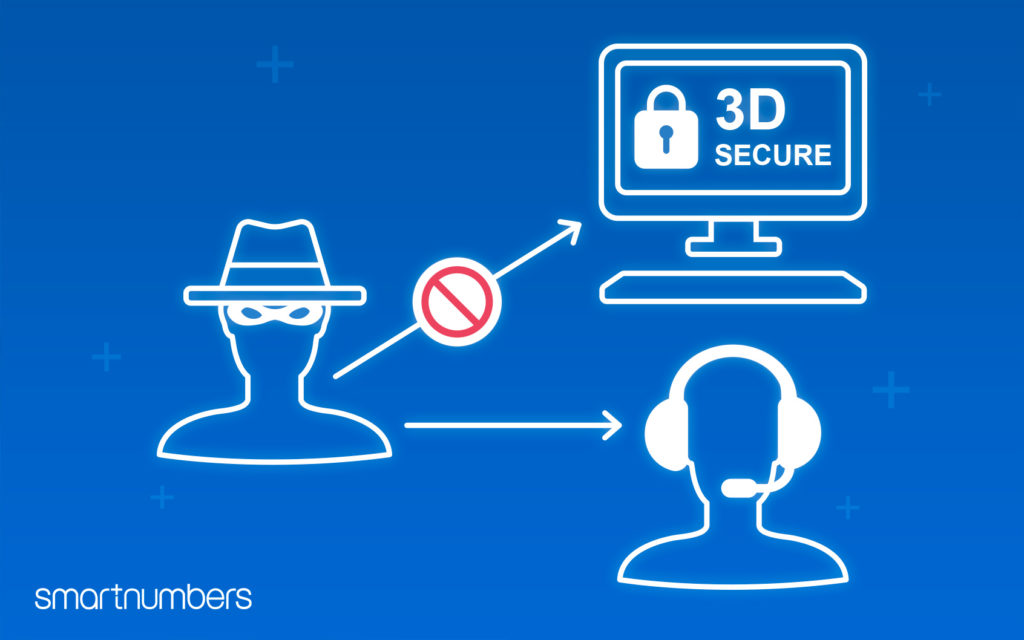

Increasingly targeted by fraudsters

With cybersecurity improving, fraudsters will turn their attention to more vulnerable channels. Without equivalent security, contact centres will be a target for fraud attacks. Additionally, internet telephony has made it simple for fraudsters to spoof their call to appear to be a genuine customer. Therefore, the CLI cannot form a trusted source of possession so the call will need manual authentication with a contact centre agent to validate their identity, impacting contact centres in several ways:

A higher volume of calls and greater contact centre costs

Faced with a more significant number of calls requiring manual authentication by an agent will increase the average call length, adding cost to the contact centre and likely to increase average hold times.

Not being able to complete self-service transactions adds customer frustration

Customers that have become accustomed to being able to execute payments at their convenience through a self-service IVR will be frustrated by the necessity to speak with an agent. By adding friction to interactions where there is a modern expectation of self-service will erode customer satisfaction.

The solution: Call DNA™ technology validates caller identity pre-answer

The Smartnumbers fraud prevention service provides the first line of defence with network-level call firewall. The authenticity of each call is determined by examining more than 50 attributes of the Call DNA™ to verify one item of the SCA ID&V process.

Analysing calls before reaching the IVR enables suspicious callers to be directed for additional scrutiny, which protects the IVR from spear phishing attacks. Meanwhile, validating call authenticity streamlines the ID&V process for genuine callers and when combined with another form of verification the caller can complete self-service transactions through the IVR. Should the caller need to speak with an agent, more time can be spent answering their enquiry rather than lengthy identity inquisition.

Find out more about Smartnumbers fraud prevention here.