How we protect insurance contact centres

Professional fraudsters will abuse any vulnerabilities they find to defraud insurance companies for financial gain – and for many, that means targeting the contact centre.

Insurance fraud can be difficult to spot

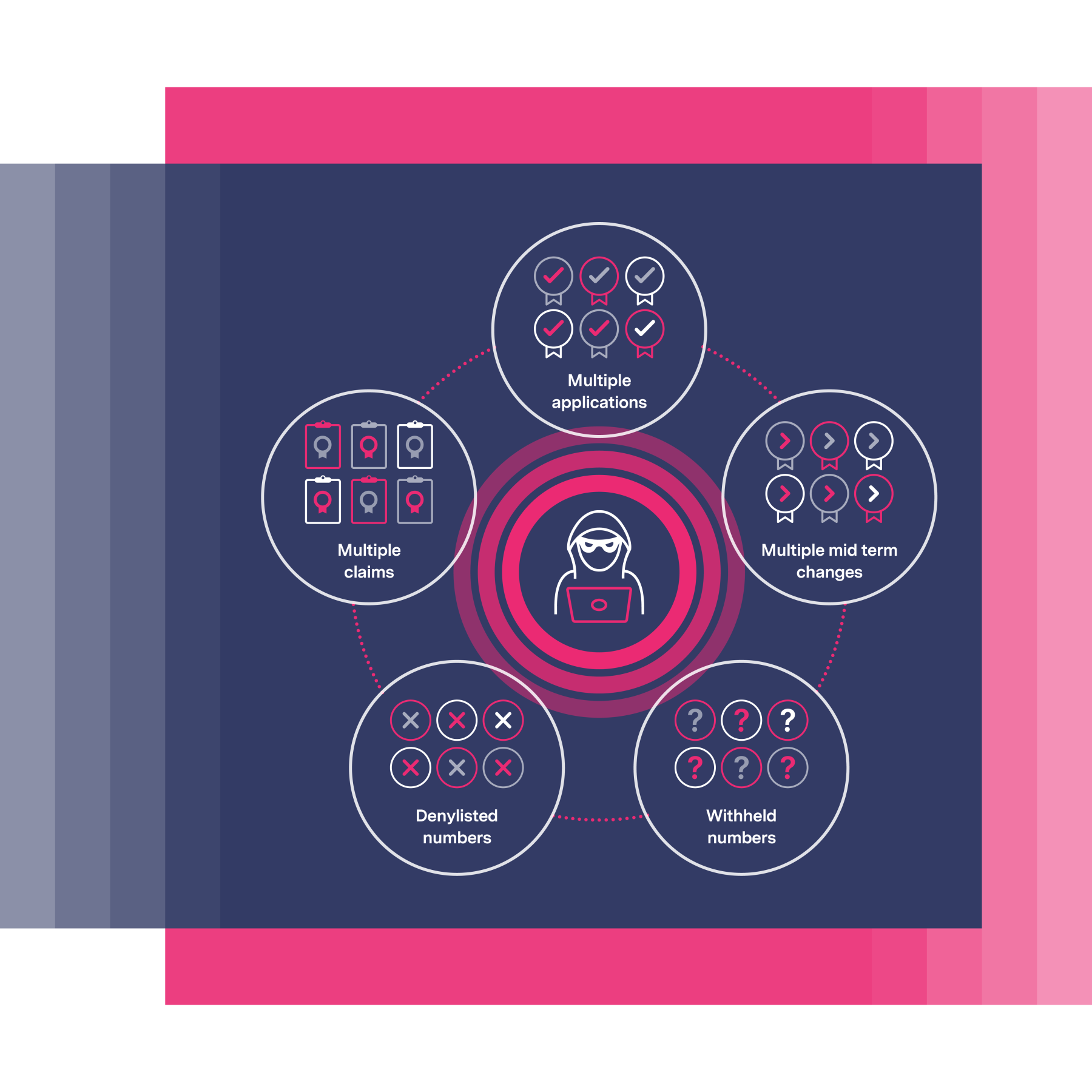

Typical types of insurance fraud can be tricky to spot using standard online checks. But often fraudsters will exploit the relative vulnerability of the contact centre, and when they do, there are certain traits that can help identify them:

- Calls from the same number to apply for multiple similar policies, across multiple providers

- Multiple calls to make mid term changes to policies, such as address changes or adding additional drivers to motor polices

- Calls from the same number to make multiple claims, across multiple accounts and policies – also across multiple providers

- Calls from denylist numbers flagged internally or by other organisations, including banks or telcos

- Attempts to avoid detection by withholding or using multiple phone numbers

With the right technology in place, it is possible to spot these patterns and flag callers displaying these traits in the contact centre and stop fraud in its tracks.

Delivering value for insurance companies

Just how bad is it?

One leading insurance company knew their contact centres received some suspicious calls. They just didn’t know how big the problem was, so Smartnumbers helped them evaluate it.

The company asked us to help them monitor incoming calls for new motor insurance policies.

The findings

- Fraud found included ghost-broking and applications made using stolen identities

- Previously unknown fraud cases were uncovered and new fraudsters discovered

- Some of the fraudsters discovered were also known by large retail banks using the platform

With Smartnumbers, the fraud team is now able to investigate and resolve cases more quickly, which frees up time for them to play a much more strategic counter-fraud role within the wider organisation.