How we protect banking contact centres

Fraudsters target banking contact centres to gather information and set up accounts for attack, even if the actual transaction takes place in another channel.

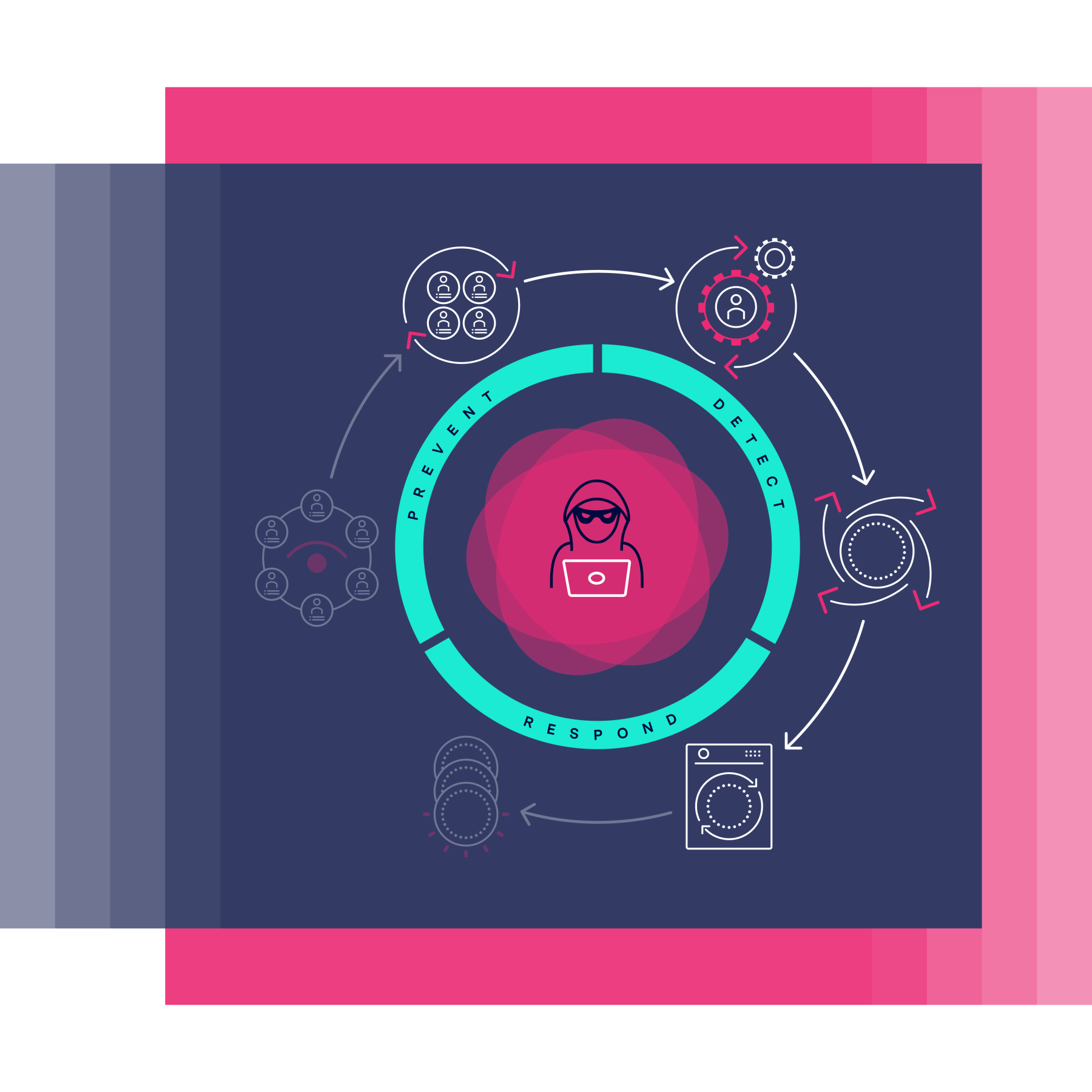

Targeting contact centres throughout the fraud lifecycle

Fraudsters carry out a number of different activities in the contact centre depending on the stage of their attack, including:

- Validating and enriching the stolen information they have, for use in consumer scams or to carry out transactions at a later stage

- Making amendments to accounts for future fraudulent activity, adding an email or changing an address for example

- Creating fraudulent loan applications in order to gain access to funds.

- Checking when stolen funds have cleared before transferring them elsewhere.

These activities are not isolated incidents – these attacks are typically carried out by organised crime groups. Teams of professional fraudsters continuously and systematically target multiple accounts, across multiple organisations and sectors, over and again.

Award winning work with banks

Our work with leading retail banks has delivered huge value to their fraud teams. Beyond the prevention of high value fraud losses, our retail banking customers share the wider benefits of using the Smartnumbers platform:

Industry collaboration

The ability to share intelligence within the platform in an easy, secure way helps confirm suspected fraudsters based on insight from other banks and provide evidence to law enforcement groups.

Valuable fraud insight

Banks gain deep insight into the methods of prolific fraudsters. Fraud teams identify information including: the different phone numbers a fraudster uses; techniques such as disguised voices or using different accents; and patterns of operation across other organisations.

Improved fraud processes

With access to more reliable information, banks can understand how fraud is evolving, and align strategy and technology across the organisation. Leveraging fraud intelligence from the contact centre helps prevent fraud in other channels.