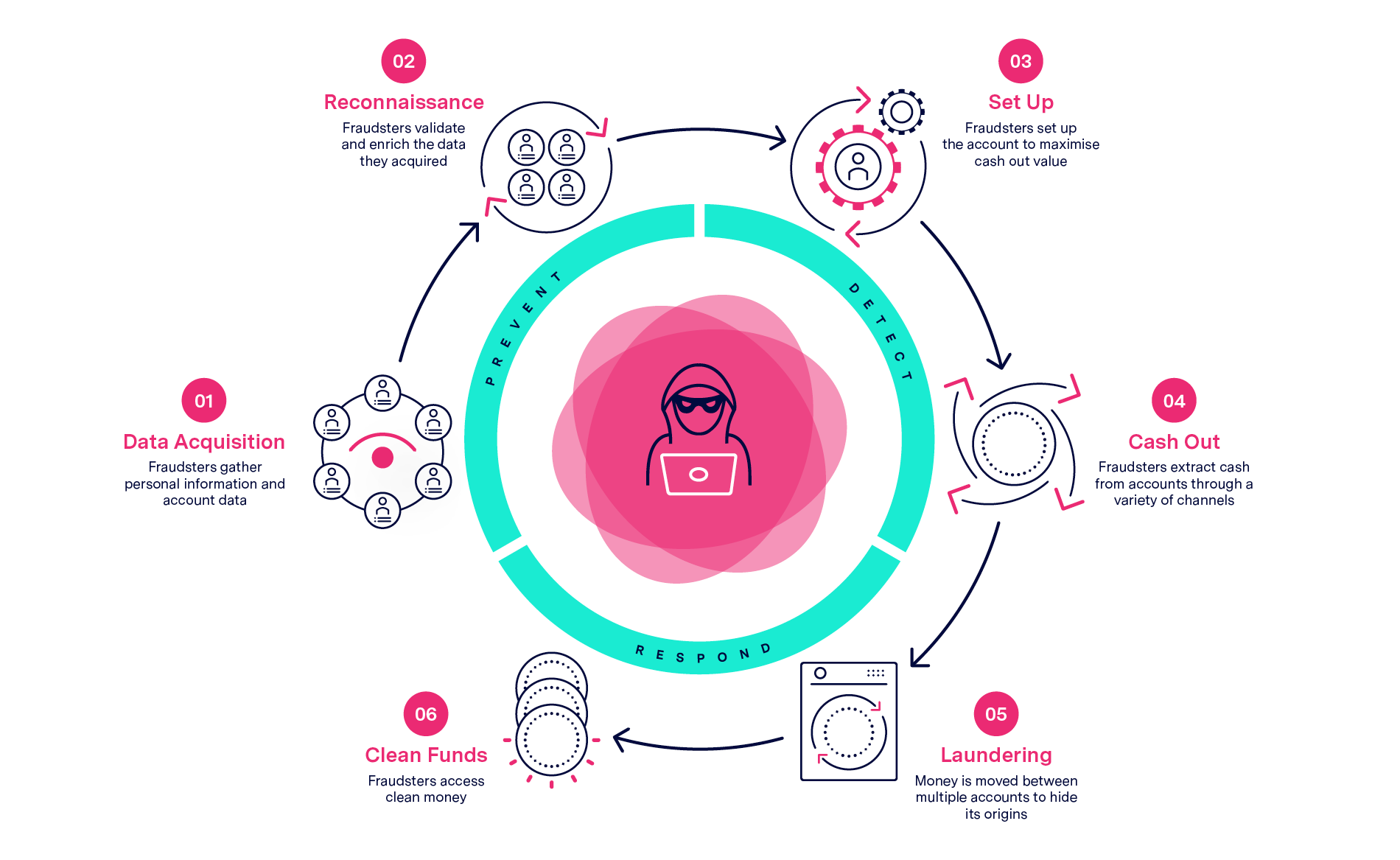

To understand in more detail how fraudsters target contact centres to help them commit fraud, it is useful to analyse the different stages of the process they go through to complete their transactions. This is known as the fraud lifecycle.

The fraud lifecycle has many different entry points into the financial system, with the different stages spanning weeks or months. Often the same individuals’ accounts are being targeted simultaneously across multiple companies too.

From the perspective of contact centres, the biggest vulnerabilities occur at steps 02 and 03 (Reconnaissance and Set Up) in this process. At these earlier stages, the fraudsters are gathering and testing the information they have. Organisations that can identify and stop this activity have the best opportunity to prevent later transactions from taking place.

The fraud lifecycle:

If you’d like to share this fraud lifecycle graphic with your team, you’ll find a downloadable version of it here.

To learn more about fraudulent activity in contact centres and how to combat it, you can read our report, Best Practice Guide: Preventing fraud in the contact centre.